Shenzhen police action: more than 400 criminals involved in 24 futures members

Advertisements are posted on radio, Weibo, and WeChat, calling you to do precious metal transactions with high returns; Luring you to do spot market gambling, being induced to frequent transactions and reverse operations, have you ever experienced such a thing?

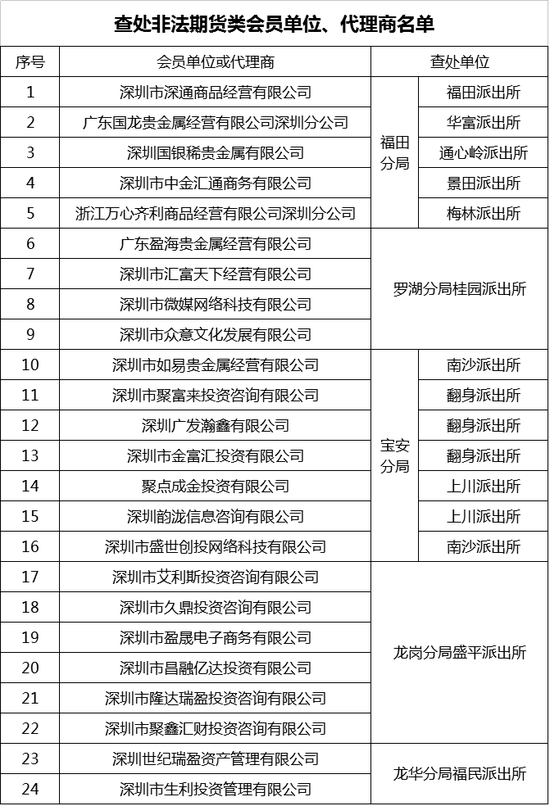

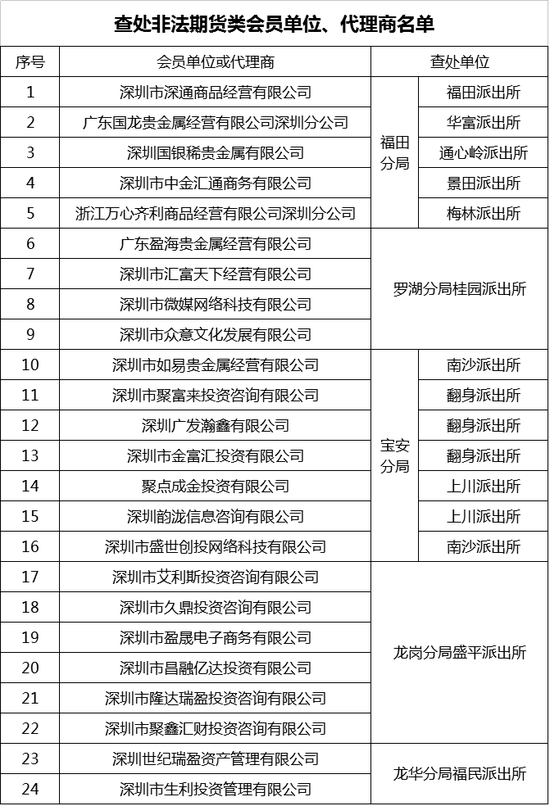

On April 12, Chinese reporters from securities dealers learned from the economic crime investigation bureau of Shenzhen Public Security Bureau that since January this year, Shenzhen Economic Investigation Detachment took the lead in organizing various branches to carry out multiple rounds of unified investigation and punishment, A total of 24 illegal futures member units (agents) were investigated and dealt with, 404 criminal suspects were detained, and 15 fugitive suspects were issued a warrant.

404 people were detained and 15 people were wanted.

On January 9 this year, the third meeting of the inter-ministerial joint meeting on clearing and rectifying various trading venues was held in Beijing. The meeting decided to basically solve the illegal problems and potential risks existing in various local trading places through centralized rectification and regulation in half a year.

Since then, the storm of clearing and rectifying various trading venues across the country has resumed.

The relevant person in charge of the economic crime investigation bureau of Shenzhen Public Security Bureau said that Shenzhen public security organs participated in the clean-up and rectification of various trading venues, and checked the clues of illegal futures crimes reported by the masses and transferred by the regulatory authorities.

The reporter learned that since January this year, Shenzhen police have investigated and dealt with 24 illegal futures member units (agents) and detained 404 criminal suspects. Approved by the procuratorate, up to now, Shenzhen public security organs have arrested 115 criminal suspects according to law, of which 108 were arrested for fraud and 7 were arrested for illegal business.

In addition, in order to fully punish the crime and find out the case, the Shenzhen Municipal Public Security Bureau reported to the Guangdong provincial public security department to issue a warrant for the arrest of 15 suspects at large.

On February 23, the economic crime investigation bureau of Shenzhen Public Security Bureau said at a press conference held with Shenzhen financial office and Shenzhen Securities Regulatory Bureau that since January this year, Shenzhen police and municipal financial office, the Municipal Securities Regulatory Bureau launched a heavy attack on illegal futures trading sites, destroyed 27 criminal dens, investigated and dealt with 24 illegal futures member units (agents), and detained 167 criminal suspects.

There are many strange modus operandi

For a long time, illegal futures have been banned repeatedly, which is also related to the criminal’s means of committing crimes. With the development of information technology, the means of committing crimes are also “keeping pace with the times”.

The investigation results released by Shenzhen police show that such illegal futures trading places and member units, together with agents, attract customers online, and the company’s employees play the roles of “profitable customers” and “calling teachers, through QQ, WeChat chat and live streaming lectures, customers are tricked into opening accounts and registering on the spot trading platform, investing funds, conducting centralized transactions on standardized contracts for bulk commodities, and actually gambling with customers on the spot market, induce frequent transactions and reverse operations of customers, and use the background of trading software to monitor and influence customer transactions, resulting in serious losses of customers and huge profits of the company.

According to the above-mentioned person in charge, these gangs engage in illegal futures trading in the name of spot exchange member units (agents) approved by relevant departments, and there are cheating and fraud in the trading process, for example, men dress up as women’s clothing, induce customers to place orders in gold, and there is a gambling relationship between customers and illegal units and agents during the communication process, which eventually leads to a huge loss of customers’ investment, with the maximum amount of damage reaching 6 million.

Avatar “beauty” to develop customers

At 16 o’clock on February 14, 2017, investor Zhou went to Guiyuan police station of Luohu branch to report that she met a woman Zhou XXX on the Internet in May, 2016, and then under the introduction of the woman, it was defrauded by Shenzhen branch of Guangdong Huifu world Precious Metals Co., Ltd. to open an account and stir-fry silver for more than 600 million yuan.

At 16:00 on February 17, Shenzhen Luohu branch dispatched more than 200 police officers to conduct surprise inspections on several office locations such as Guangdong Huifu world Precious Metals Co., Ltd. Shenzhen branch and Shenzhen Zhongyi Culture Development Co., Ltd, A total of more than 60 people involved in the case were brought back, a batch of property involved was seized, and 16 people including Hu Moumou who was suspected of committing the crime were detained according to law.

On March 24, the People’s Procuratorate of Luohu District, Shenzhen city approved the arrest of 11 suspects, including Hu Moumou, for fraud.

The survey results show that the Shenzhen branch of Guangdong Huifu world Precious Metal Management Co., Ltd recruits agents and salesmen as member units of Guangdong precious metal trading center, mainly through QQ, weChat and other social tools incarnate the “professional trader” of “Bai Fumei” to develop investment customers. After gaining the trust of customers according to the words made by the company, by sending false profit screenshots and exaggerating investment income, lure customers to register and open accounts on the trading platform.

After the customer registers and opens an account, the company arranges the so-called “teacher” to provide technical guidance to the customer. Once the customer makes a profit, it will induce the customer to sell. After the customer loses money, it will induce plus-sized capital investment. “Teacher” uses the asymmetry of spot market information between member units and ordinary customers to induce customers to reverse trade and cause customers to break their positions; Or induce customers to frequently trade and get high handling fees.

Guangdong Huifu Tianxia Precious Metal Management Co., Ltd. Shenzhen branch adopts a market maker mechanism in the transaction process to “gamble” with customers in order to divide the principal of customers, it misleads customers with agents to conduct reverse operations, causing customers to burst into positions. Shenzhen branch of Guangdong Huifu Tianxia Precious Metal Management Co., Ltd. and agents divide the principal of customers according to the proportion.

At present, the case is still in the stage of further digging and expanding the line.

Shenzhen police reminded that investors should enhance their awareness of risk prevention, choose formal trading platforms approved by financial regulatory authorities to invest rationally, and effectively protect their legitimate property rights and interests.

2207

advertisements are posted on radio, Weibo, and WeChat, calling you to do precious metal transactions with high returns; Luring you to do spot market gambling, being induced to frequent transactions and reverse operations, have you ever experienced such a thing? On April 12, Chinese journalists from securities dealers from Shenzhen